Published On Jun 11, 2019

In today's video we learn all about the Monte Carlo Method in Finance.

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0

Check out our website http://www.onfinance.org/

Follow Patrick on twitter here: / patrickeboyle

Patreon Page: / patrickboyleonfinance

What is the Monte Carlo Method?

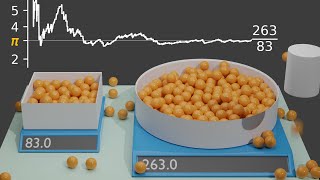

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. They are often used in physical and mathematical problems and are most useful when it is difficult or impossible to use other approaches. Monte Carlo methods are mainly used in three problem classes: optimization, numerical integration, and generating draws from a probability distribution.

In physics-related problems, Monte Carlo methods are useful for simulating systems with many coupled degrees of freedom, such as fluids, disordered materials, strongly coupled solids, and cellular structures. Other examples include modeling phenomena with significant uncertainty in inputs such as the calculation of risk in business and, in maths, evaluation of multidimensional definite integrals with complicated boundary conditions. In application to systems engineering problems (space, oil exploration, aircraft design, etc.), Monte Carlo–based predictions of failure, cost overruns and schedule overruns are routinely better than human intuition or alternative "soft" methods.

Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze complex financial instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes. This is usually done by help of stochastic asset models. The advantage of Monte Carlo methods over other techniques increases as the dimensions (sources of uncertainty) of the problem increase.

In 1977, Phelim Boyle pioneered the use of the Monte Carlo Method in derivative valuation in a Journal of Financial Economics paper.