Published On Mar 30, 2023

Join us for a shallow dive into one of the most important concepts in finance - the Black-Scholes model. In just 60 seconds, we'll break down the mathematical formula that helps determine the fair value of options, taking into account various factors such as current stock price, strike price, time to expiration, and volatility of the stock. The Black-Scholes model is widely used by traders and investors to make decisions in options trading, making it a fundamental concept in finance. Tune in to this video to gain a better understanding of options pricing and the Black-Scholes formula.

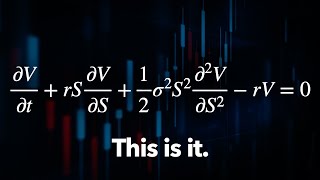

Welcome to 'Black Scholes in sixty seconds' where we break down one of the most important concepts in finance. The Black-Scholes model is a mathematical formula used to calculate the theoretical value of an option.

The Black-Scholes formula takes into account various factors, such as the current stock price, the strike price, the time to expiration, and the volatility of the stock.

The formula can be used to determine the fair value of an option and the optimal price for buying or selling options. The model is widely used to make trading decisions and is considered a fundamental concept in finance.

In short, the Black-Scholes model is a mathematical formula that helps determine the fair value of options. It's widely used by traders and investors to make decisions in options trading, and is considered a fundamental concept in finance.

Soundtrack: 'Cosmic Bloom',. Available under creative commons non-commercial, no derivatives license (c) Ketsa https://freemusicarchive.org/music/Ke...

This is not investment advice. Lucidate is not an investment advisor. Options prices can rise and fall. Always consult with a regulated financial adviser before making investment decisions