Published On Feb 22, 2021

Michael Burry just missed the GameStop stock short squeeze. This is his investment portfolio now. Despite being one of the early investors in GameStop stock, Burry's recent 13F filing shows he sold GameStop stock likely at or below $20/share. I explain why and what stocks Burry was buying instead in his 2021 stock investment portfolio.

► Access my stock portfolio & financial spreadsheets here: https://michaeljay.teachable.com/p/mi...

In this video, we will take a look into Burry’s most recent stock portfolio to get a sense of how he positioned himself for success and to help us understand the reasoning behind his investments.

We now know that as of December 31, 2020, Scion Asset Management (the firm Michael Burry runs) disclosed 0 shares of GameStop stock owned, indicating that he had sold his entire position between October and December 2020. As this was prior to the January 2021 short squeeze, Michael Burry did not participate in the squeeze he helped start back in 2019-2020. Given that GameStop stock’s highest intraday price in 2020 was around $24-26/share and it closed 2020 at $19/share, I think Michael Burry likely sold GameStop stock for around $20 per share.

Now was it a mistake to sell GameStop stock at $20? In hindsight, you could argue that it was clearly a mistake. By selling early, Burry missed the asymmetric opportunity of a short squeeze and could have potentially sold at prices 2 to 20 times higher than he did. On the other hand, Burry’s cost basis for GameStop shares was likely around $5 or less as he had been building his position in 2019-2020. Given this, by selling at $20 he locked in a +300% return in just over a year which by most objective standards is an incredible return and investment.

To get a better sense of Michael Burry’s investment philosophy and decision making process that resulted in him selling GameStop stock, we can take a look at this quote from his 2001 Shareholder Letter:

"As much as the Fund is a value fund, it is an opportunistic fund. And as much as I enthusiastically explore the value of each business behind every stock, I seek the pockets of the market that are the most inefficient, the most temporarily imbalanced in terms of price. Whatever extra return this Fund will earn will be borne of buying absurdly cheap rather than selling dearly smitten. I certainly have proven no ability to pick tops, and I do not anticipate attempting such a feat in the future. Rather, fully aware that wonderful businesses make wonderful investments only at wonderful prices, I will continue to seek out the bargains amid the refuse."

From this perspective, it made sense sell GameStop when he did. Burry makes most of his money from buying stocks cheaply and selling them when they reach fair value. While he may miss some upside if the stocks continue to appreciate above fair value, that is a calculated decision he makes.

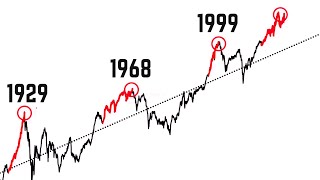

Looking at Burry’s current investment portfolio, we can learn how he is positioning for 2021 and beyond. Typical of his contrarian investment style, Burry made several bets on a recovery in both financial stocks and deep value stocks which have seen depressed share prices since the recession. Financial stocks in particular will benefit from rising interest rates in the future. Additionally, Burry’s portfolio has a noticeable absence of investments in tech or growth stocks, likely indicating he believes most of them to be overvalued at this time. In fact, while not released in this 13F, Michael Burry has disclosed publicly that he is short Tesla stock (TSLA).

Unlike longer term investors who tend to hold stocks for longer periods of time (at least a year), Burry has relatively high portfolio turnover even quarter to quarter. He has no issue with selling out of a stock position if he believes there is a more attractive opportunity available. It will be interesting to follow his portfolio developments in the future. Michael Burry's next portfolio update will likely come sometime mid-May 2021 when we will see the portfolio changes as of March 31, 2021.

If you have any questions about the content in this video or suggestions for future videos, please share them in the comments below!

DISCLOSURE: At the time of this video publishing (February 22, 2021) I am long ARCC and have no position in GME (sold my position in January 2021).

DISCLAIMER: This video is a resource for educational and general informational purposes and does not constitute actual financial advice. No one should make any investment decision without first consulting his or her own financial advisor and/or conducting his or her own research and due diligence. There is no guarantee or other promise as to any results that may be obtained from using this content. Investing of any kind involves risk and your investments may lose value.

SHARE THIS VIDEO

This video: • Michael Burry Just Missed the GameSto...

This channel: http://bit.ly/MichaelJayInvesting

Michael Jay - Value Investing