Published On May 7, 2024

📈 Try Our Membership for Free at https://bit.ly/4a9NNzO

♟️ The Charts and Analysis in this Video are available at https://www.gameoftrades.net/blog/inf...

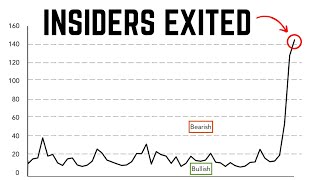

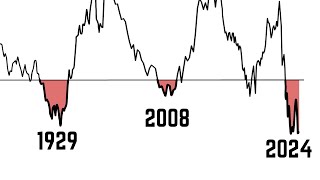

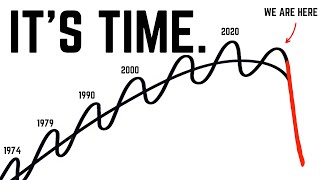

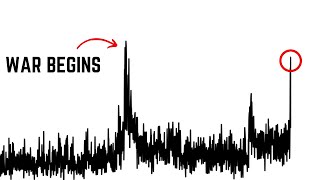

This video explores the cyclical nature of the U.S. stock market's performance, highlighting how a $1000 investment during historically high market periods like 1929, 1968, and 1999 would have significantly diminished in value over the following decade. It delves into the relationship between SP500 performance and inflation-adjusted returns, suggesting that today's investors might be facing similar risks due to the market's current high levels compared to its historical growth trends. Furthermore, it discusses the current market environment, characterized by stable interest rates and steady earnings, proposing that while the market has performed well recently, the future remains uncertain, as indicated by the volatility index (VIX) and economic indicators like copper prices.

🐦 Follow GOT on 𝕏:

/ gameoftrades_

🐦 Follow Peter on 𝕏:

/ petermassaut

🔵 Follow GOT on Linkedin:

/ game-of-trades

🔵 Follow Peter on Linkedin:

/ peter-massaut-949b20213

📹 Want to produce videos just like this? Reach out to [email protected]

DISCLAIMER: This video is for entertainment purposes only. We are not financial advisers, and you should do your own research and go through your own thought process before investing in a position. Trading is risky; best of luck!