Published On Feb 22, 2021

Abolishing amortization loans and introducing interest-only loans. Here is why the famous hedge fund manager of Eclectica AM and the passionate contrarian macroeconomist is proposing this in order to get the economy going.

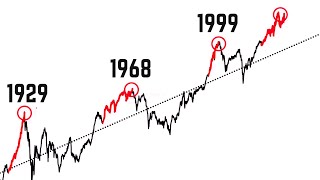

"To my mind, the three most important principles when it comes to investing are Albert Camus's principles of ethics: God is dead, life is absurd and there are no rules," Hendry once said to an interviewer. He suggested that a great fund manager was defined by "an ability to establish a contentious premise outside the existing belief system, and have it go on and be adopted by the rest of the financial community".

Hugh Hendry was the founding partner and, at various times, the chief investment officer, chief executive officer and chief portfolio manager of the now defunct firm, Eclectica Asset Management. He began to attract attention when his fund achieved a 31.2 per cent positive return in 2008 in the depths of the financial crisis, earning him a reputation as a Contrarian investor, but his claim on wider public notice was based in a series of outspoken media appearances. Hendry has been referred to as "the most high-profile Scot" in the hedge fund sector.

Hendry was born in Glasgow, Scotland, in 1969 and graduated from Strathclyde University in 1990 with a BA in economics and finance. His father worked as a lorry driver and he was the first member of his family to go to university.

This is the 'Why Make Loans Interest-Only - Hugh Hendry' clip from the interview with Hugh Hendry 'Finance Manager Interview #011 – Hugh Hendry' recorded on January 22, 2020. The printed version of this interview has been published in 'Finance Manager', the leading business weekly magazine in Slovenia.

LINKS

Hugh Hendry, interviewee: https://hughhendry.com/, / hughhendryofficial

Bostjan Usenik, interviewer & producer of the channel: / bostjanusenik

Photo courtesy: Chris Hudson