Published On Jun 23, 2021

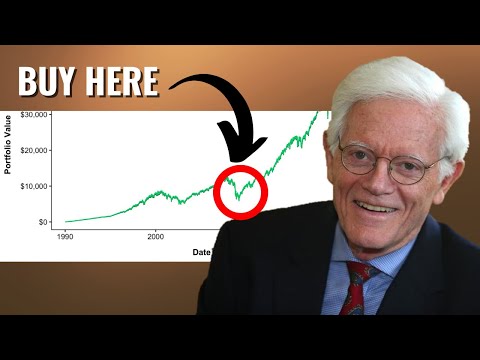

Anyone that has been following this channel knows I am a huge fan of Peter Lynch. Lynch rose to prominence running the legendary Fidelity Magellan Fund and writing books such as “One Up on Wall Street,” one of my top 5 favorite investment books. Over his 13-year career at Fidelity, the fund averaged a nearly 30% annual compounded return. Meaning $1,000 invested in his fund turned into $30,287 in little more than a decade. With a track record like that, it is clear that if you want to learn more about investing, you should learn from Peter Lynch. These impressive results are the reason I frequently incorporate lessons I have learned from studying Peter Lynch both in my personal investing and in my job as an Investment Analyst at a large investment fund based in New York City. In this video, we are going to watch one of my favorite clips of Lynch where he talks about how one of his best investments came as a result of “buying the dip” as opposed to panic selling. After the clip, we are going to break down this strategy and talk about how I applied the strategy to find an investment that made me over 3x my investment over the past 2 and a half years. The ultimate goal is for you to apply these investing lessons in your own portfolio. But first, make sure to like this video and subscribe to the channel if you aren't already because it is my goal to help make you a better investor by studying the world's greatest investors. Without further ado, let's dive in!

Let's take a second to break down the situation Peter Lynch faced when he invested in Kaiser industries because once we do, it will help you understand why Lynch was able to have the courage to buy the dip in the company’s stock price instead of panic selling when the stock fell in value. For background, Kaiser industries was a conglomerate. Put simply, it was a large company that owned many smaller companies. Kaiser industries owned companies such as Kaiser Aluminum, Kaiser Steel, and Kaiser Cement. Lynch was able to identify this company as undervalued and an attractive investment. He bought a large amount of stock at $14 a share. However, after the purchase the stock price continued to fall pretty substantially, all the way to $3 a share. Why did Peter Lynch not panic sell like most investors did at the time? It is because he truly understood what the company did and continued to believe the underlying fundamentals of the business remained strong, despite what happened with the stock price. This is why he continued to buy more and more shares as the price fell. Once the company hit its low of $3 a share, the company was so undervalued that the management of the company was forced to dissolve the conglomerate and distribute the businesses that it owned to the people that owned the shares. Shareholders received cash from the sales shares in the affiliated companies. For every 100 shares of Kaiser Industries, a stockholder got 25 shares of Kaiser Aluminum, 13 shares of Kaiser Steel and 7 shares of Kaiser Cement. Once this happened, the value of the company increased dramatically, making this investment once of Lynch’s most successful investments of all time.

Here are the main takeaways for investors: 1) truly understand the company behind the stock you own. If you view stocks as companies with underlying business fundamentals as opposed to just pieces of paper that float around in price, you will be more comfortable with price fluctuations. That leads me to the second main takeaway: if the underlying fundamentals of the business remain unchanged but the stock price is declining, that could be a sign of a great buying opportunity either to start a new position in a stock or add to your holdings in that stock.