Published On Feb 22, 2024

Left unchecked, swelling pension deficits estimated at over $6.5 trillion could eventually bankrupt state economies and hurt public services like infrastructure and education, negatively impacting the lives of all Americans. Alternative retirement plans can provide a lifeline to governments and households. Transitioning workers to sustainably-structured retirement plans like a 401(k) allows states to save money and remain solvent, and still provide employees with reliable benefits and financial security.

Be sure to visit The Hoover Institution at https://www.hoover.org/ and PolicyEd at https://www.policyed.org/

Check Out More from Oliver Giesecke:

Read "How Much Do Public Employees Value Defined Benefit Versus Defined Contribution Retirement Benefits?" by Oliver Giesecke and Joshua D. Rauh here:

https://www.hoover.org/research/how-m...

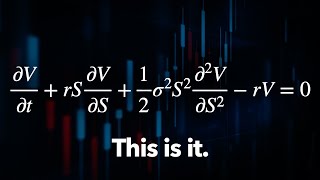

Read "Public Pensions Are Mixing Risky Investments with Unrealistic Predictions" by Oliver Giesecke and Joshua D. Rauh here:

https://www.gsb.stanford.edu/insights...

Read "Trends In State And Local Pension Funds" by Oliver Giesecke and Joshua D. Rauh here:

https://www.hoover.org/research/trend...