Published On Apr 8, 2021

The easiest way to spot a trend reversal is using moving averages.

#trendreversal #forex #daytrading

The trading floor is a new project that I just launched.

World class day trading education and tools

https://www.trdfloor.com/welcome

FunderPro

Start your funded account challenge HERE (20% discount with link)

https://funderpro.com/get-funded-with...

my twitter / artybryja

For charts Use Trading View

https://www.tradingview.com/?aff_id=1...

New Official Telegram Group

TMA OFFICIAL®

https://t.me/TMAbyArty

Looking for a forex broker?

I use Osprey

https://ospreyfx.com/tradewithtma

regulated broker i recommend is Blueberry markets

https://bit.ly/blueberrytma

Try a $100,000 funded account from OspreyFX

https://ospreyfx.com/tradewithtma

Use coupon code

movingaverage50

To get $50 off

Sign up for a $100,000 FTMO funded account here

https://trader.ftmo.com/?affiliates=i...

Get a free audio book from audible

https://tmafocus.com/2WyXSqa

Links to the indicators

TMA Overlay

https://www.tradingview.com/script/zX...

TMA Divergence indicator

https://tmafocus.com/3nfcEfd

TMA shop

https://shop.spreadshirt.com/themovin...

Get some free stocks from WEBULL

https://tmafocus.com/3p0vatP

also

Get some free stocks from Public

https://tmafocus.com/3GUUojh

Trading Platform

META TRADER 4

Simply put, a reversal occurs when a stock changes trend and starts to move in the opposite direction of previous price action. Psychologically, reversals can be incredibly difficult for even the most experienced investors to react to. That's because in the early stages of a reversal, the market still shows many indications of a continued move in the original direction.

The market meltdown of 2008 was a good example of a powerful downtrend that was difficult to spot the end of. While the lows of March 2009 are easy to spot with the benefit of hindsight, it was considerably more difficult to go long stocks in 2009 after the market had already punished bulls so fiercely in the preceding year.

Image placeholder title

By the time skittish mainstream investors had piled onto the stock-buying game, a significant chunk of the market's initial move was already behind it. Improving reversal recognition is one remedy for that.

Naturally, markets aren't always trending. Quite often, markets can trade without a discernible direction.

How to Identify a Reversal Early

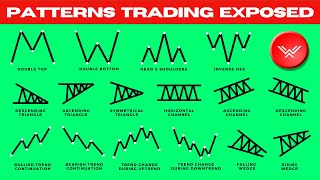

One of the most effective tools for spotting a reversal is also the most simple: the trend line. A trend line connects intermediate lows or highs of a stock; in an uptrend, it connects lows (or troughs), while in a downtrend it connects peaks.

The chart above of the S&P during 2008 is a perfect example of that. By relying on the long-term trend lines rather than gut feelings, you would have been out of the market early and back in early.

As with most technical tools, trend lines aren't set in stone; they're subject to adjustment as a stock's price action works itself out.

Momentum oscillators are another tool that can help you spot reversals. Oscillators are technical indicators that are banded between two extreme numbers or have a base value. These momentum gauges can signal overbought or oversold conditions when they're at extremes.

Common oscillators include RSI, MACD and Stochastics. Don't be fooled into common practice with oscillators. While a move to oversold or overbought territory does indicate a reversal could be forthcoming, it's actually quite common for stocks to keep running as momentum continues to accelerate.

NOT FINANCIAL ADVICE DISCLAIMER

The information contained here and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided here and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information. The Company expressly recommends that you seek advice from a professional.

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.