Published On Premiered Mar 3, 2021

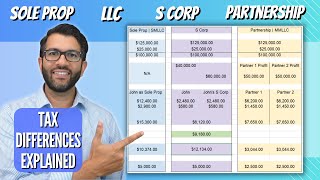

By a Trusted CPA: Which is better - a Sole proprietorship, LLC, S-Corporation, or C-Corporation?

Become a Tax Client: https://mycpacoach.com/tax-planning-s...

Find out the best business entity to save on taxes by watching this full video.

Subscribe: https://bit.ly/2HJlq46

Your tax expense can greatly vary based on the entity you select for your business..

And by greatly, I mean thousands if not tens of thousands of dollars.

By the end of this video, I hope that you’re saving thousands and not paying thousands more than you have to in taxes.

Outline:

Intro: (0:00)

Legal vs Tax Entity: (1:15)

Pass-through Taxation: (1:50)

Double Taxation: (2:30)

Self-Employment Tax: (3:05)

Taxes for Sole Proprietors & Partnerships: (4:10)

Taxes for LLCs: (5:50)

Taxes for S-Corps: (7:15)

What is a Reasonable Salary?: (9:05)

Which Entity is Best for YOU?: (10:20)

Want to learn more about LLCs? Watch our LLC playlist: • The Best Business Entity to Save on T...

Interested in talking with someone from our team? Sign up to get notified when we are accepting new clients here: https://lyfeaccounting.com/coming-soon/