Published On Aug 20, 2022

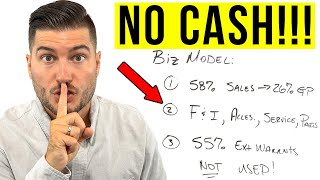

A car dealer was forced to pay $66,000 after illegally keeping their customer's $5,500. The judge awarded treble damages of $16,500, $20,000 for emotional distress, and $29,000 in attorney's fees. The contract signed between the parties did not allow the dealer to keep the down payment, but they did anyway. Was it worth it? Not this time.

#Car #cars #lawyer

SUBSCRIBE ON YOUTUBE / whitneyllp

By: Daniel W. Whitney, Jr., Esq.

Whitney, LLP

409 Washington Ave, Ste 750

Towson, MD 21204

410 583 8000 - Phone

[email protected]

We primarily represent consumers in Maryland.

Call Us For a Free Consultation

VISIT OUR WEBSITE: https://www.whitneyfirm.com

To Find a Lawyer to Help with Car Dealer Problems In a State other than Maryland:

National Association of Consumer Advocates:

https://www.consumeradvocates.org/fin...

Before becoming a lawyer, I sold cars while I was in college. It was while selling cars in Maryland that I learned of the ruthless nature of car dealerships, and learned there is only one rule that matters at most dealerships: GET AS MUCH MONEY AS POSSIBLE FROM THE CUSTOMER, TODAY, AND NOTHING ELSE MATTERS.

Consumers must know they have more legal rights than they realize, and can take action against dishonest dealers. #dealership #newcars #usedcars

Common car dealer problems and scams I help car buyers with include:

1. Car dealer forged the buyer’s signature on a second finance contract.

2. Dealers selling a car without having the title. happens all the time

3. Changing the monthly payment and amount financed after the deal is done.

4. False online price advertising when the online price increases at the dealership.

5. Bogus reconditioning and inspection fees for illegal profits.

6. Selling vehicles that did not pass state inspections.

7. Forcing customers to buy extended warranties and vehicle service contracts.

8. Spot Delivery Violations - when financing is not approved:

9. Dealer keeps the down payment although financing is not approved;

10. Dealer sells the trade although financing is not approved;

11. Dealer forces customer to sign a contract with worse terms; and

12. Dealer forces customer to keep the contract and not allow them to cancel.

13. Charging illegal finance charges and passing along exorbitant bank fees.

14. Car dealer does not disclose rental history or other prior commercial use.

15. Credit Application fraud - creating fake jobs or inflating salary.

16. Car dealer runs credit without permission.

17. Car dealer refuses to cancel the extended warranty or steals the refund money.

18. Car dealer uses out of state sister dealership and charges illegal fees and interest.

19. Taking advantage of bad credit and low credit buyers.

20. Stealing down payments

Common resolutions to car dealer cases once dealers are sued include:

1. Financial restitution including actual damages (meaning actual money the buyer spent).

2. Unwinding the deal, meaning the buyer returns the car and gets all of their money back.

3. Dealer buys the car back for the remaining payoff and returns the down payment and fees.

4. Cancelling a warranty or service contract and getting the refund.

5. Getting the trade-in back.

6. Having the down payment returned.

7. Dealers pay the buyer's attorney’s fees.

We do our best to educate consumers as to the common problems and scams with car dealerships and to fight back when buyers are taken advantage of. Some other great channels for information about car dealerships and auto fraud dealer schemes are Kevin Hunter @KevinHunter , @ChevyDude and @WhiteBoardFinance .

Here is our blog on our dealer cases and dealer legal issues: https://bit.ly/3bFkTeK

Here are descriptions of some of our past car dealer settlements: https://bit.ly/3pG2pzN

This YouTube Channel and this video are not legal advice and do not provide legal advice. An attorney-client relationship with Whitney, LLP is created only once a representation agreement is signed by Whitney, LLP and the client. Prior results are not a guarantee of future results, and all cases are different. Thank you for watching.