Published On Aug 16, 2020

Join this channel to get access to perks:

/ @stockinvestmentanalysis

Welcome to another Stock Investment Analysis video! In today’s video we compare Verizon and AT&T side by side as stated in the title. However, as an added bonus, I am also going to be comparing them both to T-Mobile and Comcast. In this video, I will answer the question, which of these media and telecommunication service companies is the best investment. We will also take an in-depth look at the companies’ characteristics, historical growth, forecasted growth, dividends, whether AT&T will cut its dividend, returns, valuation, margins, company safety and stability, and risk. If you have ever considered investing in these companies or have already done so, make sure you watch to the end to get a better understanding of these companies and some of the most important investment data to consider.

Before I break down all of this information for you, please take a moment to subscribe so you never miss a future video and like this video to help get it out to more people who are interested. If you want to become a member of my channel, please feel free to join by clicking the join button at the bottom of the screen. If you want more information about the perks you get from joining, please watch the video linked at the top of this video.

If you live in the United States, I am sure you have already heard of all four of these companies and are likely quite familiar with them. However, for those outside of the US, you may not have heard of them so I will briefly explain the companies. Comcast, AT&T, and Verizon have a huge amount of power in terms of the media and are three major internet service providers in the United States. Comcast owns notable companies like Universal, USA network, 37% of Hulu, Dreamworks, Buzzfeed, CNBC, NBC, and so on. AT&T owns Time Warner, HBO, Warner Brothers, CNN, Cinemax, TNT, DC, CW, and so on. Verizon owns Yahoo and the Huffington Post among others. In fact, after the Time Warner Merger, AT&T alone owned 98 companies.

AT&T and Verizon were the largest telecommunications companies in the world by revenue in 2018. Comcast was at 5th. T Mobile is also a US telecommunications carrier which has historically been much smaller than AT&T and Verizon. However, after its 2019 merger with Sprint, the fourth largest US carrier, the combined subscribers number put it above AT&T. Here you can see that back in 2019, Verizon had almost 90M subscribers compared to AT&T’s 75M. With the merger, T Mobile would be 79.07M. So, in summary, these four companies are primarily focused on providing internet, phone, and other telecommunications services and media services.

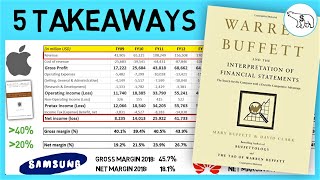

If you are interested in AT&T stock, Verizon Stock, T-Mobile stock or Comcast stock, make sure you watch this video. In this video, I compare AT&T (T), Verizon (VZ), Comcast (CMCSA), and T-Mobile (TMUS) on Company Characteristics, Historical Growth, Forecasted Growth, Dividends, Returns, Valuation, Margins, and Company Safety. Within those categories, I analyze a large number of variables including: price to earnings ratio, price to sales ratio, price to free cash flow ratio, price to book ratio, dividend, dividend yield, debt to equity ratio, fair value, target price, forward PE, the PEG ratio, EPS, EPS growth, dividend growth, return on assets (ROA), return on equity (ROE), return on investment (ROI), normal PE, forward price to sales, gross margins, operating margins, profit margins, interest coverage, short term debt coverage, debt paydown yield, credit rating, current ratio, quick ratio, free cash flow yield, and beta. I compare the stocks on each of these metrics but also compare each stock to its own history.

Which stock do you believe is the best investment? Please share your thoughts in the comments below. I look forward to hearing from you. Make sure to subscribe and hit the like button, and as always, good luck with your investing.

Connect on Social:

Facebook: / stock.investment.analysis

Twitter: / st0ckinvestment

Instagram: / stockinvestmentanalysis

Data used in this video was taken from:

www.fastgraphs.com

www.fidelity.com

www.finviz.com

www.finbox.com

DISCLOSURE: I currently own T and VZ with plans to likely sell in the near-future.

DISCLAIMER: All information and data on this YouTube Channel is solely for entertainment purposes. The information herein is based solely on my personal opinion and experience. All investments hold inherent risk, and the information provided on this YouTube Channel should not be interpreted as guidance, recommendations, offers, advice, or suggestions. Any ideas and strategies discussed on this channel should not be implemented without first considering your financial and personal circumstances or without consulting a financial professional.