Published On Oct 16, 2023

Billionaire investor Bill Ackman just issued a warning about the future of inflation. But don’t worry, it’s not all bad news, and you will see why during this video. For background, Ackman recently gave a rare, full length, sit down interview. While this interview touched on a wide range of topics, it was Ackman’s comments around inflation that really caught my attention. You are going to want to hear what he had to say. In this video, we are going to cover Ackman’s thoughts on the economy, why inflation is here to stay, and arguably most importantly, how you can protect your money from the devastating impacts of high inflation. Let’s get into it.

In order to prevent the US from slipping into deflation, the US federal reserve established a target annual inflation rate of 2% in the year 2012. For much of the next 8 years, the Fed struggled to get inflation up to that 2% target. As a result, many economists believed that inflation would never again be a problem in the United States. Oh boy how things can change and they definitely changed in a major way in 2020.

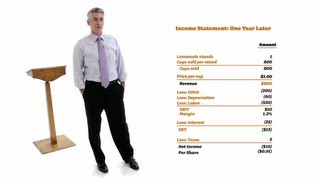

To understand why Ackman thinks inflation is here to stay, you have to understand why inflation occurs. In simple terms, inflation happens when the demand for goods or services outstrips supply. While that may sound like a complicated concept, trust me, it’s actually very simple. Here, we have a supply and demand graph. This line here represents the demand for a particular good or service

In this example, let’s say we are talking about used cars. The demand line represents the number of people looking to purchase a used car, and importantly, how much those buyers are willing and able to pay. Here, we have the supply line. This supply line represents the number of used cars available to be purchased at any given time. The point at which our two lines here cross represents the price for that good or service. So in our example, the average price of a used vehicle.

In 2020 and 2021, the US government and Federal reserve took drastic steps to prevent a widespread economic collapse. This involved sending cash directly to households, boosting unemployment benefits, and pausing required payments on certain types of debt. At the same time that all of this cash was getting pumped into the economy, the Federal reserve slashed interest rates to historically low levels. These lower interest rates made it less expensive for people and businesses to borrow money to make purchases.

Going back to our example with used cars, these actions resulted in an increase in demand for used cars. People had more money in their bank accounts to be able to spend to make the purchase. Additionally, the lower rates made it less expensive to purchase a car using a loan. These factors led to an increase in demand, illustrated by our demand line here getting pushed to the right

At the same time, automotive manufacturers were suffering through supply chain issues that limited their ability to produce new cars. Since there were less new cars available, people held on to their current car longer, resulting in less supply of used vehicles available for sale. Less supply means our supply line gets pushed to the left. Notice how now the two lines cross at a much higher price pointy