Published On Aug 12, 2021

📆 Check Out My Service Offering As A Fee-Based, Independent, Lifestyle Financial Planner: https://my.profileme.app/pieterdevill...

If you’ve started taking an interest in your personal finances, chances are good that you’ve been introduced to the Tax Free Savings Account being offered to South African citizens. And doesn’t it just give you the absolute tingles when you think about paying less to tax to the South African government? I know for me it does…

And yes, this is arguably one of the best investment instruments available to us, but only if you really understand how to use it effectively. So in this video, I will explain why a TFSA is so powerful, how much money you can expect to save on Tax inside a TFSA, what you should consider putting inside your TFSA, where to invest your TFSA and if you should invest in it monthly or just make a lump sum investment every year.

I’ve added timestamps in the description if you want to jump to the sections that most interest you, but I do want to encourage you to watch the whole video so that you can get a proper understanding on how to effectively become a millionaire using these strategies.

I hope that this video helped to convince you that a TFSA is arguably one of the best deals in South Africa. If you are thinking of starting to invest, then a TFSA should be your first priority. After you reach its contribution limits, then start adding to a RA or pension fund. But before doing any of this, make sure you have proper insurance as well as a 3 to 6 months’ worth of living expenses in an emergency fund.

Here is a breakdown of the info covered in this video:

00:00 Introduction

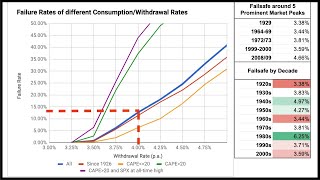

02:40 Tax payable on normal investments

05:56 How much tax will a TFSA actually save?

07:28 Which asset classes should you include in your TFSA?

13:14 Where to invest your TFSA

15:53 Lump sum vs Debit order for a TFSA

18:07 How to move a TFSA

19:13 Take home message

Articles mentioned in this video:

How much tax will a TFSA save you: https://rb.gy/tghquy

Comparison of best Unit trusts and ETFs for a TFSA: https://rb.gy/w2n3oh

Where other S'africans are invested: https://rb.gy/jmzlzl

________________________________________

My Product Recommendations: 👇

📚 Download My FREE eBook Containing 200+ Money Saving Life Hacks: https://moneymarx.ck.page/guide

🎥 All the gear I use to make my YouTube Videos: https://kit.co/MoneyMarx

________________________________________

✅ Follow me on Social Media 👉

Website: https://my.profileme.app/pieterdevill...

Instagram: / mrmoneymarx

TikTok: / mrmoneymarx

Twitter: / money__marx

Facebook: / mrmoneymarx

LinkedIn: / drpieterdevilliers

For business inquiries: [email protected]

#PersonalFinance #Investing #Southafricanyoutuber

________________________________________

My name is Dr. Pieter Marx de Villiers, and I'm a Veterinarian turned Financial Advisor from South Africa who aims to retire by the age of 35. Follow me in my journey towards Financial Freedom in (hopefully) just 10 years! :)

This channel will help you achieve your Personal Financial Goals through the things I’ve learned and researched to improve my own Financial Health.

If you enjoy the content and find any value in my videos, consider Subscribing and help me reach my goal of 30 000 Subscribers on YouTube in 2024!

Lekker!

________________________________________

DISCLAIMER

Whilst I am a Registered Financial Advisor under the FSCA as of June 2023, the content on this YouTube Channel and all of my other Social Media Platforms are for Educational Purposes only and should not be taken for Financial Advice. You and only you are responsible for your financial decisions and must therefore conduct your own research and seek the advice of a licensed Financial Advisor where necessary.

Some of the links on this page are affiliate links, meaning, at no additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. Affiliate commissions help fund videos like this one.